You are here:iutback shop > block

Can the Fed Regulate Bitcoin?

iutback shop2024-09-21 11:06:49【block】7people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the rise of cryptocurrencies, particularly Bitcoin, has sparked a heated debate amo airdrop,dex,cex,markets,trade value chart,buy,In recent years, the rise of cryptocurrencies, particularly Bitcoin, has sparked a heated debate amo

In recent years, the rise of cryptocurrencies, particularly Bitcoin, has sparked a heated debate among economists, investors, and policymakers. One of the most pressing questions surrounding Bitcoin is whether the Federal Reserve (Fed) can regulate it. This article aims to explore this issue, examining the potential challenges and opportunities that arise from the Fed's involvement in regulating Bitcoin.

Firstly, it is crucial to understand the nature of Bitcoin. Unlike traditional fiat currencies, Bitcoin operates on a decentralized network known as the blockchain. This network allows for peer-to-peer transactions without the need for intermediaries such as banks. The decentralized nature of Bitcoin raises the question of whether it can be effectively regulated by a centralized authority like the Fed.

The Fed's primary role is to maintain monetary stability and regulate the banking system. However, Bitcoin's decentralized nature poses a significant challenge to the Fed's traditional regulatory framework. The Fed's ability to regulate Bitcoin hinges on its ability to monitor and control transactions, which is difficult to achieve in a decentralized network. Moreover, the Fed's regulatory powers are limited to the United States, whereas Bitcoin is a global phenomenon. This creates a complex scenario where the Fed's jurisdiction is stretched thin.

Despite these challenges, the Fed can still regulate Bitcoin in several ways. One approach is to impose regulations on financial institutions that deal with Bitcoin. By doing so, the Fed can exert indirect control over Bitcoin transactions within the United States. For instance, the Fed can require banks to report suspicious activities related to Bitcoin transactions, thereby helping to prevent money laundering and other illegal activities.

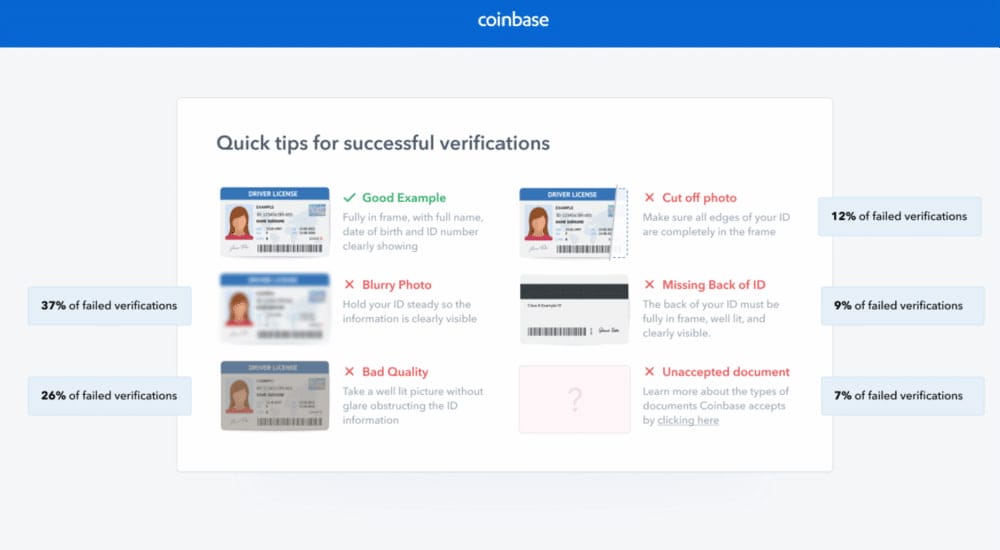

Another way the Fed can regulate Bitcoin is by implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. These policies would require individuals and businesses to verify their identities before engaging in Bitcoin transactions. This would make it easier for the Fed to track and regulate Bitcoin transactions within the United States.

Furthermore, the Fed can collaborate with international regulators to address the global nature of Bitcoin. By working together, regulators can establish a unified framework for monitoring and controlling Bitcoin transactions across borders. This would help to mitigate the risks associated with cross-border Bitcoin transactions and ensure compliance with international standards.

However, there are significant concerns about the potential drawbacks of regulating Bitcoin. One concern is that excessive regulation could stifle innovation and hinder the growth of the cryptocurrency industry. Bitcoin's appeal lies in its decentralized and transparent nature, which allows for faster, cheaper, and more secure transactions. Over-regulation could erode these benefits and lead to the decline of Bitcoin as a viable alternative to traditional fiat currencies.

Moreover, the Fed's involvement in regulating Bitcoin could lead to a loss of trust in the cryptocurrency. Many Bitcoin enthusiasts view it as a revolutionary technology that can disrupt the traditional financial system. If the Fed were to impose heavy-handed regulations, it could undermine the credibility of Bitcoin and discourage its adoption.

In conclusion, while the Fed can regulate Bitcoin to some extent, the challenges posed by its decentralized and global nature make it a complex issue. The Fed can impose regulations on financial institutions, implement KYC and AML policies, and collaborate with international regulators to address the risks associated with Bitcoin. However, it is crucial to strike a balance between regulation and innovation to ensure the continued growth and development of the cryptocurrency industry. The question of whether the Fed can effectively regulate Bitcoin remains a topic of debate, and only time will tell how this issue will unfold. Can the Fed regulate Bitcoin? The answer lies in finding the right balance between regulation and innovation.

This article address:https://www.iutback.com/eth/19d31499666.html

Like!(7)

Related Posts

- Does Mining Bitcoin Take Up Internet?

- Binance Removed iPhone App: What Does It Mean for Cryptocurrency Users?

- Binance Chart Trading: A Comprehensive Guide to Mastering the Art of Cryptocurrency Trading

- Meta Coins on Binance: A Comprehensive Guide to Trading and Investing

- What is a Cold Wallet Bitcoin?

- What's a Bitcoin Price: Understanding the Fluctuations and Factors Influencing Cryptocurrency Value

- Can You Buy Bitcoin on Schwab? A Comprehensive Guide

- Bitcoin Price China: The Current State and Future Prospects

- How Many Bitcoin Cash Are Left: The Current Status and Future Outlook

- Is It Bad to Buy GPUs After Bitcoin Mining?

Popular

Recent

Title: Exploring the World of Fun USDT Binance: A Comprehensive Guide

How to Find Bitcoin Wallet on Hard Drive: A Comprehensive Guide

**SPV Wallet Bitcoin Gold: A Secure and Efficient Solution for Cryptocurrency Users

How to Find Bitcoin Wallet on Hard Drive: A Comprehensive Guide

Bitcoin Price Prediction Summer 2022: What to Expect

How to Withdraw Crypto from Binance: A Step-by-Step Guide

Title: Enhancing Security and Accessibility: The Bitcoin Gold Linux Wallet

What's a Bitcoin Price: Understanding the Fluctuations and Factors Influencing Cryptocurrency Value

links

- **Trias Binance Listing: A Milestone for the Cryptocurrency Community

- Mining Problems Bitcoin: Challenges and Solutions

- Bitcoin Coins Price: The Ever-Changing Landscape of Cryptocurrency

- Can't Buy BNB on Binance? Here's What You Need to Know

- Bitcoin Mining Power Usage: The Current State and Future Prospects

- The Rise of Eternity Chain Binance: A Game-Changer in the Crypto World

- Bitcoin Coins Price: The Ever-Changing Landscape of Cryptocurrency

- Binance Change Wallet Address: A Comprehensive Guide to Managing Your Cryptocurrency Transactions

- What is Bitcoin Mining Hardware?

- Bitcoin Wallets Online: The Ultimate Guide to Secure Digital Asset Storage